28+ mortgage origination points

For example lets say you take out a 200000 30-year fixed-rate. Web Mortgage origination points are fees homebuyers pay to online mortgage lenders for originating reviewing and processing their loans.

Refinance Updated Platinum Home Mortgage Corporation

Web A mortgage origination fee is a fee charged by the lender in exchange for processing a loan.

. Learn about their advantages and whether or not you should use. Web A mortgage origination fee is a charge from your lender that covers processing costs. Web MoneyGeek details what mortgage points are and how they affect mortgage payments.

Home buyers pay the origination fee which is typically about 05 of the amount. Say you buy one point on a mortgage loan of 300000 which costs. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web The origination point is the loan fee that your broker or lender charges. Origination points are non. Ad Get All The Info You Need To Choose a Mortgage Loan.

For example if youre looking to purchase a 200000 home. Loan B has no origination fee but comes with an APR of 1199. They can be a percentage of the loan amount or come in the.

Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool. On average a loan origination fee is about one. Choose The Loan That Suits You.

Loan origination fees vary by lender and usually depend on how much youre borrowing. Web Origination points are mortgage points used to pay the lender for the creation of the loan itself whereas discount points are mortgage points used to buy. Discount points have a set cost of 1 of your mortgage amount.

If you take out a 200000 loan and you pay two points your fee will be 4000. Web Loan A charges a 2 origination fee and has a 999 APR. Web How Much Do Discount Points Cost.

Web Origination points are fees which may or may not be charged by your particular mortgage lender. Web Origination fee and points have different effects on your loan. Web Origination points are the fees charged by banks in return for reviewing processing and approving your home loan application.

Web How much are loan origination fees. Choose Wisely Apply Easily. Special Offers Just a Click Away.

Here are some of the things you should know about this charge. Web Whereas mortgage points are credits you buy to earn a lower interest rate origination points are fees you pay to the lender at closing to process your mortgage. Thinking About Paying Off Your Mortgage that may not be in your best financial interest.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Both loans have five-year repayment. Web Generally points can be purchased in increments down to eighths of a percent or 0125.

Web Up to 25 cash back So you might have to pay four points to reduce your rate by a full percent. Ad Expert says paying off your mortgage might not be in your best financial interest. It is typically between 05 and 1 of the total loan amount.

Web Yes loan origination fees are one component of your mortgage closing costs. Find the One for You. Ad Compare the Lowest Mortgage Rates.

Origination fee is a mandatory cost that you have to pay at closing regardless of your interest rate.

Ex 99d1g004 Jpg

What Are Mortgage Points Detailed Guide New Silver Lending

Interest Rates Explained By Raisin

What Are Points And Should I Pay Them

:max_bytes(150000):strip_icc()/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

How Mortgage Points Work

Mortgage Points The Homebuyer S Guide Prevu

:max_bytes(150000):strip_icc()/GettyImages-185275489-f8772df32b2a47dca0ca4e014e6b0a2c.jpg)

Origination Points Meaning Examples In Mortgages

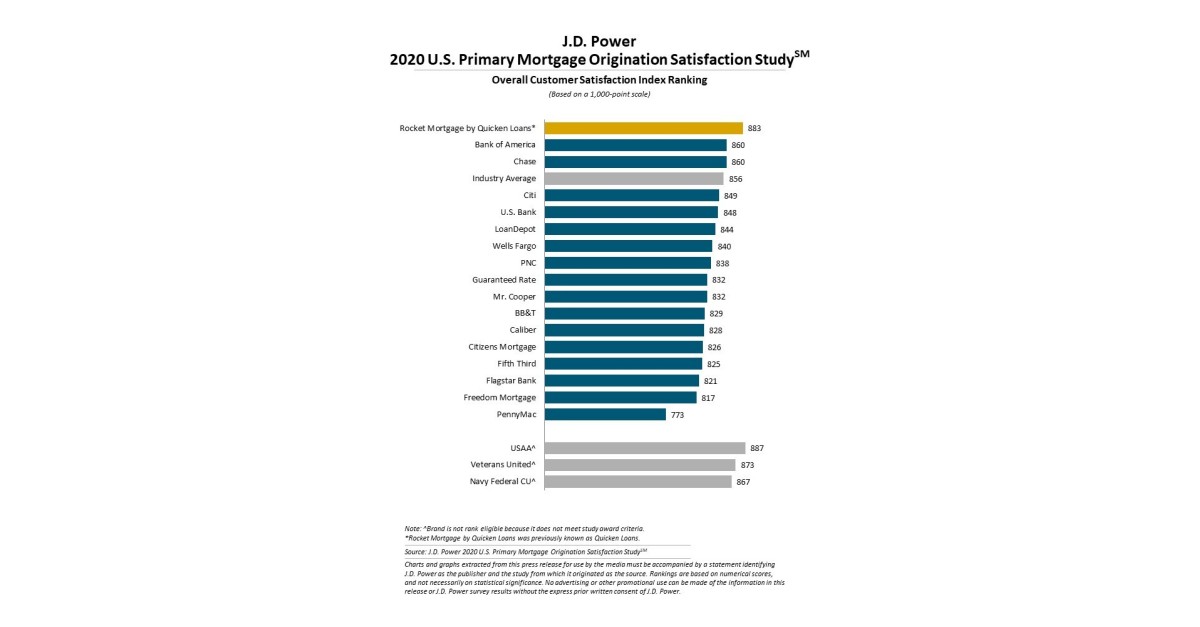

Mortgage Originations Are On Pace For Best Year Ever Wsj

Ex 99d1g003 Jpg

How Mortgage Points Work

Image 002 Jpg

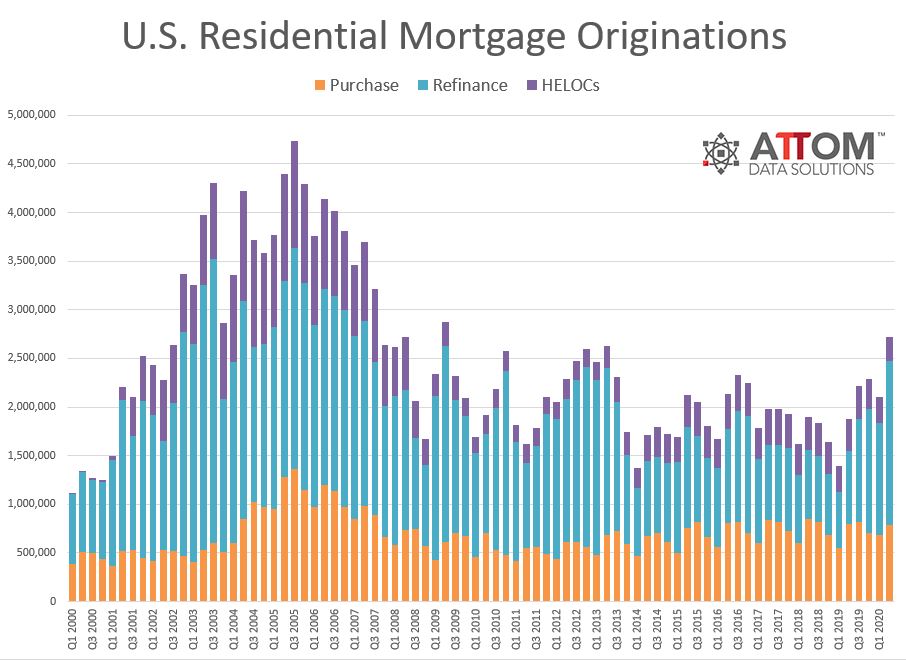

Residential Refinance Mortgages Make Up Nearly Two Thirds Of Home Loans In Q2 2020 Dfd News

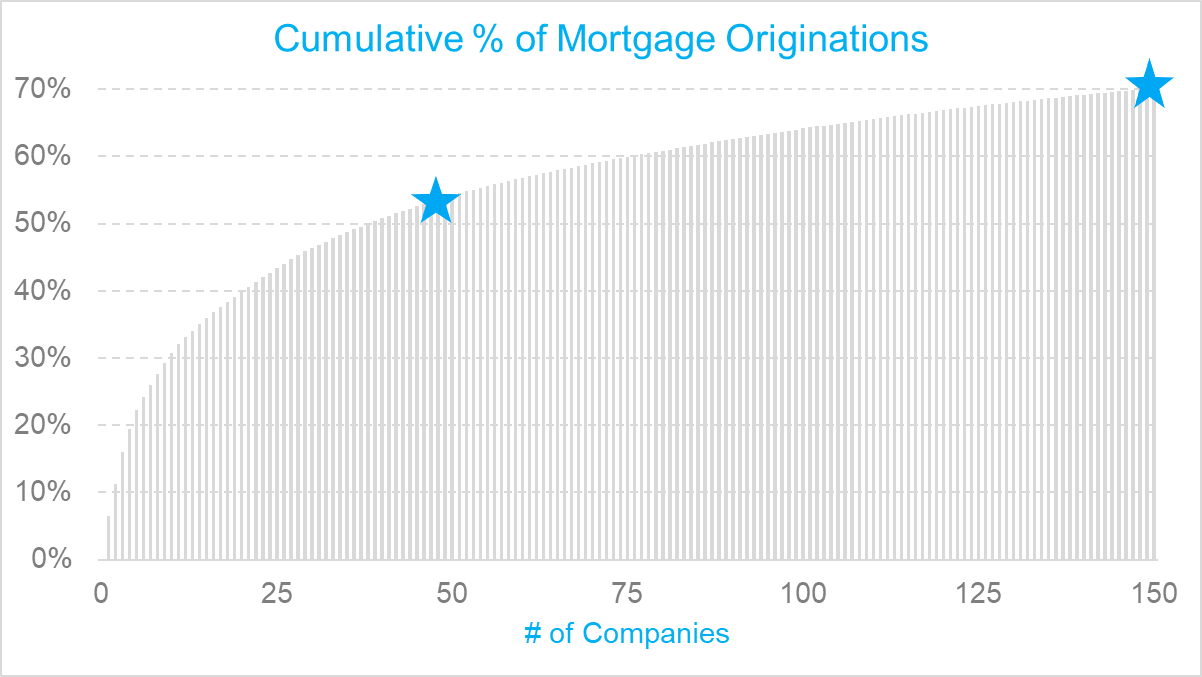

The Top 150 Mortgage Lenders In 2019 Bundle

October 14 2012 Edition Of The Wichita Eagle By Jean Hays Issuu

Mortgage Points Calculator Nerdwallet

Sec Filing Midland States Bancorp Inc

Mortgage Points Calculator 2023 Complete Guide Casaplorer